Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

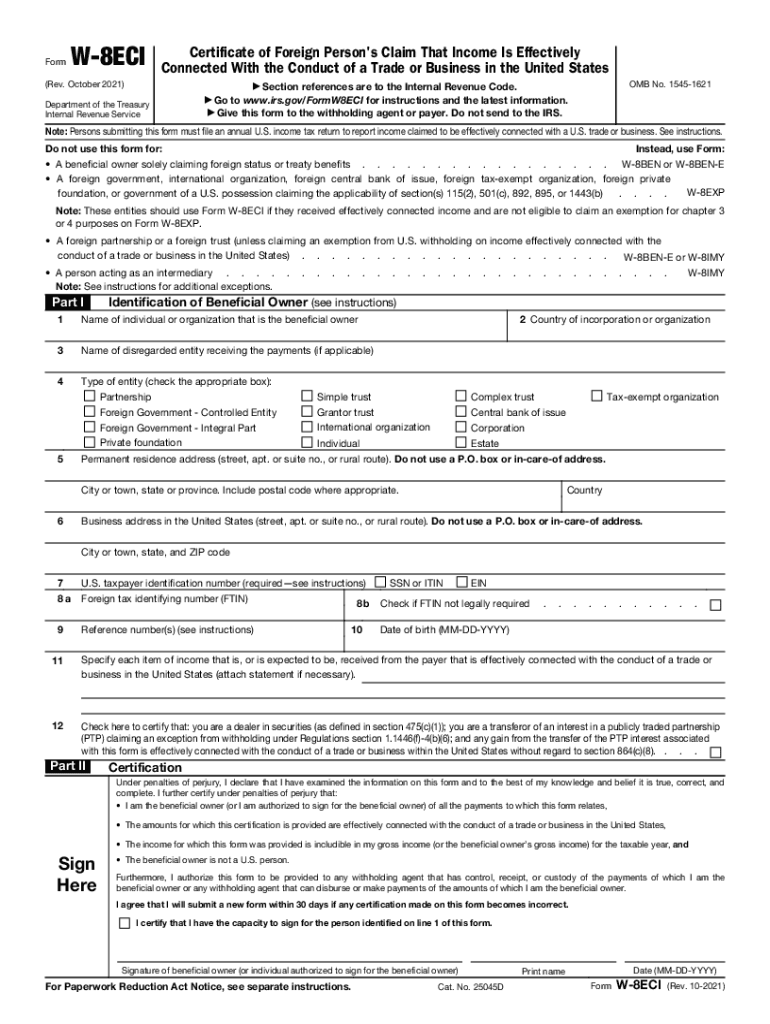

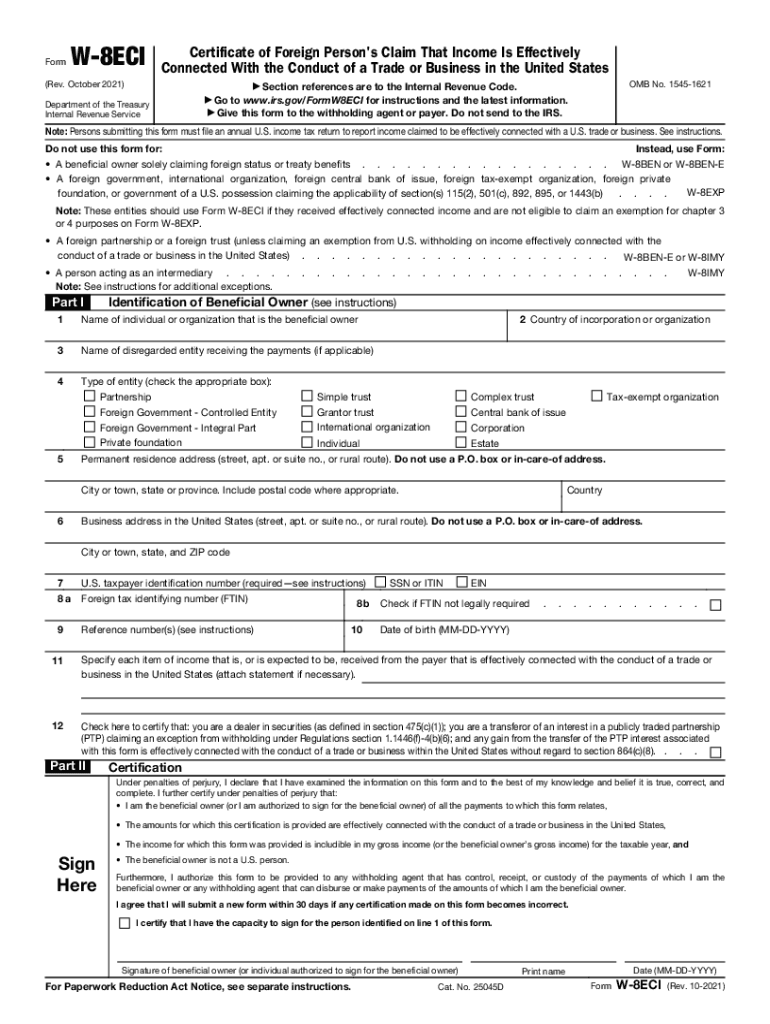

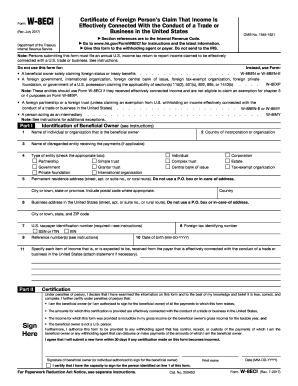

W 8ECI stands for “W-Eight Expanded Certification Information,” which is a form used by the Internal Revenue Service (IRS) to determine the correct amount of tax withholding for nonresident aliens. This form is used to certify a nonresident alien’s status, identify the wages they are receiving, and determine the correct amount of taxes to be withheld from their paychecks.

Who is required to file w 8eci?

Any individual or entity that is not a U.S. citizen and is receiving income from a U.S. source must file Form W-8ECI. This includes non-U.S. citizens, foreign corporations, and other foreign entities.

What information must be reported on w 8eci?

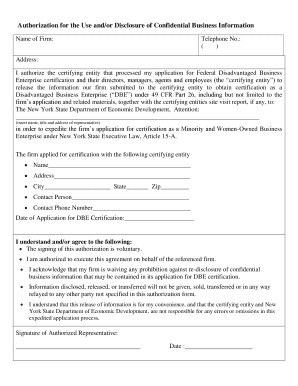

The W-8ECI form requires the following information:

1. Name

2. Permanent residence address

3. Country of residence

4. U.S. taxpayer identification number (TIN)

5. Certification that the income is not effectively connected with the conduct of a U.S. trade or business

6. Signature of the foreign individual

To fill out Form W-8ECI, follow these steps:

1. Provide your name and address: Write your full name, complete address, and the country where you are tax resident.

2. Check the appropriate box: Indicate whether you are an individual or an entity by marking the appropriate box.

3. Taxpayer identification number (TIN): Fill in your taxpayer identification number issued by your country of tax residence. If your country does not issue TINs, state this in the appropriate box.

4. Claim of tax treaty benefits: Indicate if you are eligible for any tax treaty benefits by checking the box and providing the applicable treaty article number.

5. Effectively connected income (ECI): If you have income that is effectively connected with the conduct of a trade or business within the United States, check the box and provide a description of your business activities in Part III.

6. Exemption from withholding: If you are claiming an exemption from withholding tax on certain types of income, check the appropriate box and provide specific details, including the type of income and the applicable IRS Revenue Procedure or regulation.

7. Signature and date: Sign and date the form to certify that the information provided is true, correct, and complete to the best of your knowledge.

Please note that it is advisable to consult with a tax professional or a certified public accountant for guidance specific to your situation, as tax requirements can vary depending on individual circumstances and applicable tax treaties.

What is the purpose of w 8eci?

The purpose of Form W-8ECI is to provide confirmation to the Internal Revenue Service (IRS) that a non-U.S. individual or entity claiming exemption from U.S. income tax on effectively connected income (ECI) has a valid basis for that claim.

ECI refers to income earned in the United States that is effectively connected with a trade or business conducted by a non-U.S. taxpayer. When a foreign individual or entity has ECI, they may be subject to U.S. tax on that income. However, if they qualify for an exemption or a reduced tax rate under a tax treaty, they can submit Form W-8ECI to certify their eligibility for such tax benefits.

By submitting this form, the non-U.S. taxpayer declares that the income they are earning is considered effectively connected with a U.S. trade or business, and they are eligible for the benefits outlined in the specific tax treaty agreement with the United States. This form helps ensure proper compliance with U.S. tax laws and facilitates the correct withholding of taxes on income earned by non-U.S. individuals or entities that is effectively connected with a U.S. trade or business.

When is the deadline to file w 8eci in 2023?

The deadline to file Form W-8ECI for the tax year 2023 is generally April 15, 2024. However, it is always advisable to consult with a tax professional or refer to the official IRS website for any potential updates or changes to the filing deadlines.

What is the penalty for the late filing of w 8eci?

The penalty for late filing of Form W-8ECI (Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States) depends on the specific circumstances. As of this writing, the penalty for failing to provide a timely and valid form to a withholding agent can result in a withholding tax being applied to certain transactions at a default rate of 30%.

It's important to note that tax laws and penalties can vary based on individual circumstances and jurisdiction. It is recommended to consult with a tax professional or the appropriate tax authority to obtain accurate and up-to-date information regarding penalties for late filing of Form W-8ECI.

How can I send w 8eci to be eSigned by others?

When you're ready to share your w 8eci instructions pdf form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in w 8eci form without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit form w 8eci and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit w8 form on an Android device?

You can make any changes to PDF files, such as w 8eci form pdf, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.