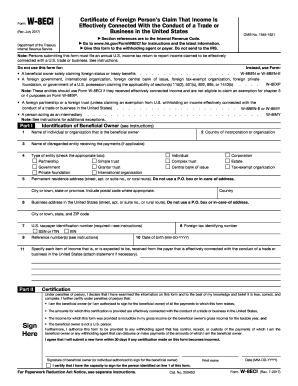

IRS W-8ECI 2021-2025 free printable template

Show details

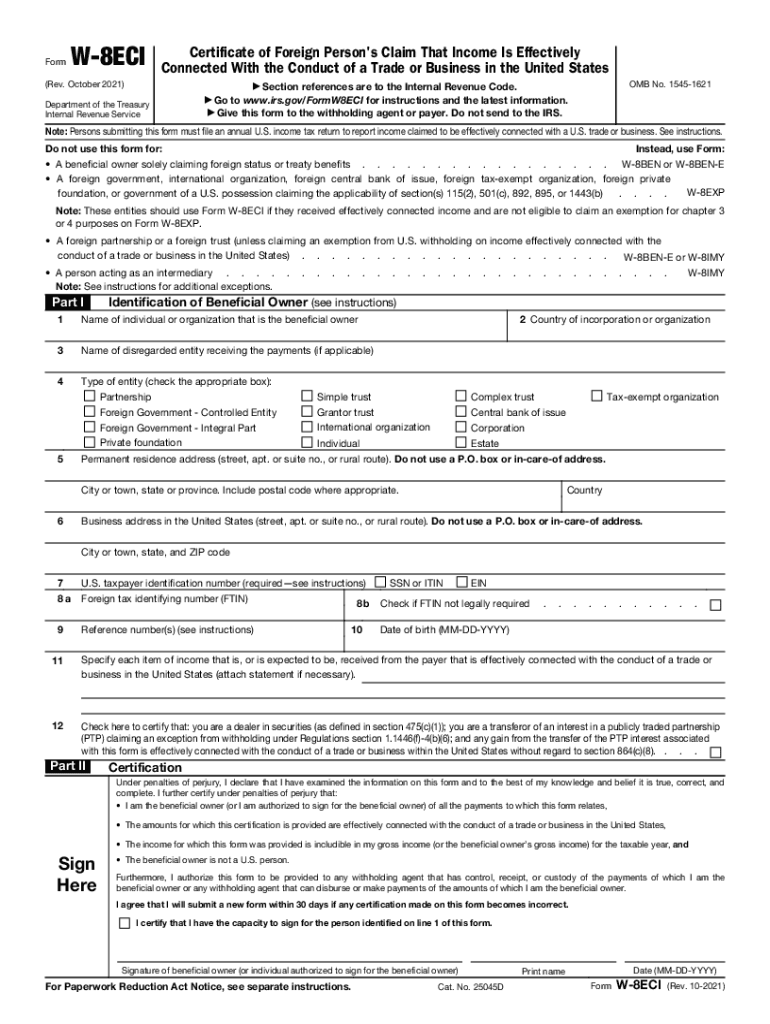

FormW8ECICertificate of Foreign Person\'s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States(Rev. October 2021) Department of the Treasury Internal

pdfFiller is not affiliated with IRS

Understanding and Utilizing the IRS W-8ECI Form

Detailed Instructions for Editing the W-8ECI Form

Guidelines for Completing the IRS W-8ECI Form

Understanding and Utilizing the IRS W-8ECI Form

The IRS W-8ECI form is crucial for foreign entities conducting business in the United States. It ensures that those entities can claim a reduction or exemption from U.S. withholding taxes on income effectively connected to a U.S. trade or business. Proper completion and submission of this form is a key step in navigating U.S. tax regulations successfully.

Detailed Instructions for Editing the W-8ECI Form

Follow these steps to accurately edit the W-8ECI form:

01

Obtain the latest version of the W-8ECI from the IRS website.

02

Fill in your entity's name and country of incorporation accurately.

03

Enter your U.S. taxpayer identification number (if applicable).

04

Provide the address of your permanent residence or corporate office.

05

Specify the type of income that is effectively connected to your U.S. trade or business.

06

Review all information for accuracy before finalizing the form.

Guidelines for Completing the IRS W-8ECI Form

Completing the W-8ECI involves specific fields that need careful attention:

01

Name of organization: This should reflect the legal name as registered.

02

Entity classification: Indicate whether you are a corporation, partnership, or other entity types.

03

Tax identification number: Provide a U.S. TIN if applicable, or indicate if not.

04

Permanent address: Must be outside of the U.S. to qualify for tax benefits.

05

Nature of income: Clearly state the types of income, e.g., rents, dividends, or services.

Show more

Show less

Recent Developments Regarding the IRS W-8ECI

Recent Developments Regarding the IRS W-8ECI

Recent updates to the W-8ECI reflect ongoing changes in tax law and compliance expectations:

01

Updates to definitions of effectively connected income were implemented in 2022.

02

The IRS revised the instructions for clearer guidance on foreign corporations in 2023.

03

Implementation of electronic filing options for international entities is now available.

Essential Insights on the IRS W-8ECI Form

Defining the IRS W-8ECI Form

The Purpose Behind IRS W-8ECI

Who Is Required to Complete This Form?

Conditions for Form Exemption

Critical Components of the W-8ECI Form

Deadline for Submitting the IRS W-8ECI

Comparative Analysis of the W-8ECI with Similar Forms

Transactions Covered by the W-8ECI

Submission Requirements for the W-8ECI Form

Consequences of Failing to Submit the W-8ECI

Required Information for Filing the W-8ECI

Other Forms That May Accompany the W-8ECI

Where to Send the IRS W-8ECI Form

Essential Insights on the IRS W-8ECI Form

Defining the IRS W-8ECI Form

The IRS W-8ECI form serves as a declaration of tax status for foreign entities earning income connected to a U.S. business. It's designed to ensure correct withholding practices, facilitating compliance with U.S. tax obligations.

The Purpose Behind IRS W-8ECI

This form aims to prevent double taxation by allowing foreign entities to pay U.S. taxes only on income generated effectively in the U.S. By completing the W-8ECI form, entities can provide documentation that can lead to the reduction of withholding tax rates under applicable income tax treaties.

Who Is Required to Complete This Form?

Foreign businesses and organizations that receive income connected with a U.S. trade or business must complete the W-8ECI. For instance, a foreign corporation that rents property in the U.S. or offers consulting services to U.S. clients must file this form.

Conditions for Form Exemption

Exemptions from filing the W-8ECI can apply under specific conditions:

01

Entities earning less than $1,000 in effectively connected income.

02

Certain types of income exempt under U.S. tax treaties, like interest from certain sovereign debts.

03

Nonresident aliens with income that isn’t U.S. sourced or effectively connected.

Critical Components of the W-8ECI Form

The W-8ECI contains several key components essential for completing the form:

01

Name of beneficial owner: Individual or entity claiming the income.

02

Tax identification number: To establish tax status.

03

Certification section: Attest to the truthfulness of the information provided.

Deadline for Submitting the IRS W-8ECI

The W-8ECI must be submitted before the payment is made to avoid undue withholding taxes. Typically, this should align with regular payment schedules to ensure compliance with U.S. tax regulations.

Comparative Analysis of the W-8ECI with Similar Forms

When comparing the W-8ECI to other related forms:

01

W-8BEN: Used by individuals to certify foreign status and claim treaty benefits.

02

W-8BEN-E: Similar to W-8BEN but for entities, also used to claim tax treaty benefits.

Transactions Covered by the W-8ECI

The W-8ECI is applicable for various transactions, including:

01

Rent payments for real property.

02

Profits from the sale of services or products in the U.S.

Submission Requirements for the W-8ECI Form

When filing the W-8ECI, only one signed copy needs to be provided to the withholding agent. Maintaining a copy for your records is advisable for future reference.

Consequences of Failing to Submit the W-8ECI

Failing to properly file the W-8ECI can lead to significant penalties, including:

01

A maximum withholding tax of 30% on U.S. sourced income.

02

Potential audits or legal actions for non-compliance.

03

Loss of eligibility for tax treaty benefits.

Required Information for Filing the W-8ECI

When completing the W-8ECI, be prepared to provide:

01

Full legal name and address of the entity.

02

U.S. taxpayer identification number (if applicable).

03

Classification of the organization under IRS definitions.

Other Forms That May Accompany the W-8ECI

Depending on your circumstances, you may need to submit other forms alongside the W-8ECI, such as:

01

W-8BEN for individuals claiming tax treaty benefits.

02

Form 8233 for independent personal services.

Where to Send the IRS W-8ECI Form

The completed W-8ECI form should be submitted directly to the withholding agent or U.S. payer making the payment, not to the IRS. Ensure you follow any specific submission guidelines provided by the recipient.

Understanding the W-8ECI form is essential for foreign businesses operating within the U.S. tax framework. Properly preparing and submitting this form can prevent unnecessary taxation and ensure compliance with U.S. laws. For assistance, consider reaching out to tax professionals specializing in international tax compliance.

Show more

Show less

Try Risk Free